Supply chain disruptions have affected virtually all industries, here in the U.S. and around the world, over the last year or more. Product inventories and entire industries, such as travel and hospitality, shrank significantly due to low demand caused by the pandemic throughout 2020. When lock downs and travel restrictions eased and vaccinations became available, demand for products and services accelerated more quickly than anticipated. The supply chain has yet to catch up and was dealt another blow by the highly contagious Omicron variant causing high absentee rates among workers across industries worldwide.

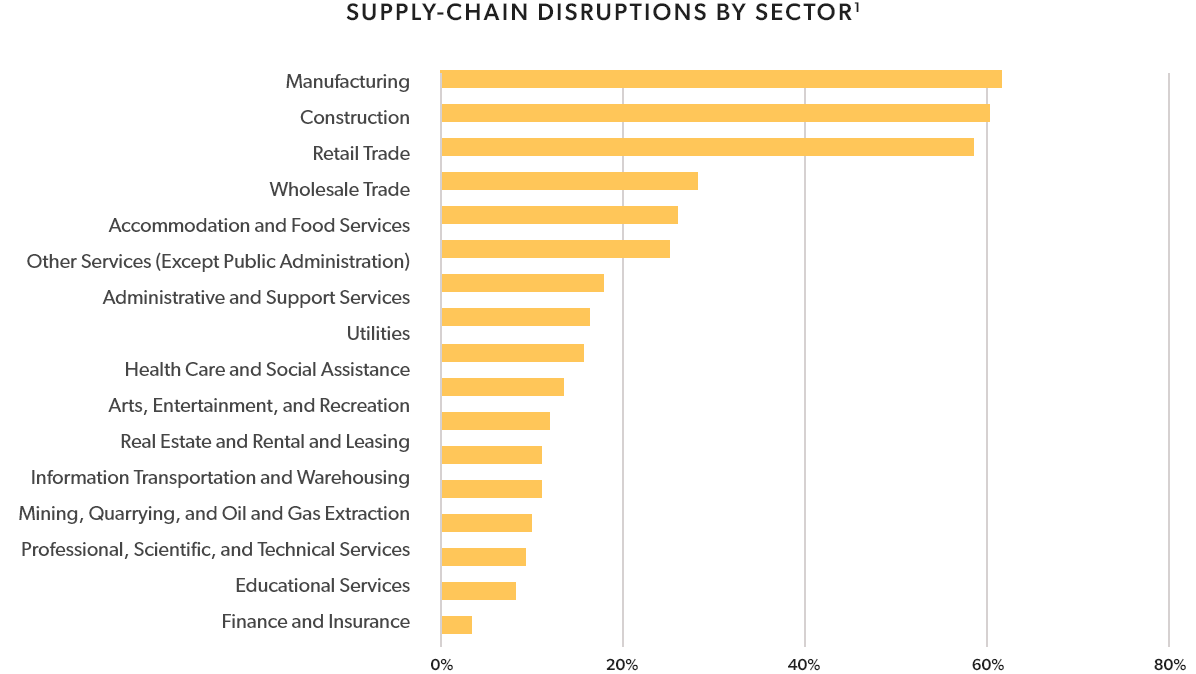

The global supply chain for goods and services is actually multiple supply chains containing many links, any one of which can fail and disrupt the flow of business for a host of industries. A report from the White House last summer indicated that all major business sectors reported some level of supply chain disruption.1

This is largely because so many industries are interdependent for wholesale parts, raw materials, packaging, shipping, etc. And every component within each supply chain is in some way dependent on labor, which has been in unexpectedly short supply.

The COVID-19 pandemic caused job losses in a number of ways. Early on government-enforced shutdowns made it difficult to impossible for some business to operate, while also causing a huge decrease in demand for some products and services. Other businesses were compelled to cease or reduce operations due to worker safety concerns. Millions of workers lost their jobs directly and others were forced to resign in order to look after their children, care for elderly or disabled relatives, or because they feared exposure to the virus.

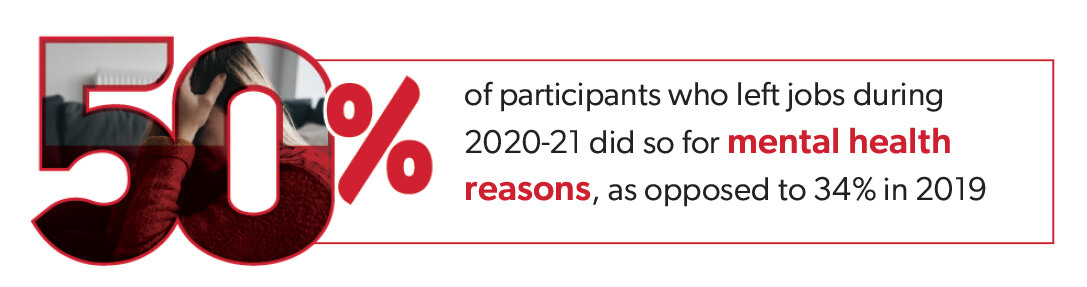

Other workers left their jobs due to mental health concerns that were caused or made worse by stresses of the pandemic, such as overwork and the pressures of dealing with unruly or unpleasant customers. According to one study, 50% of participants who left jobs during 2020-21, did so for mental health reasons, as compared to 34% who cited mental health as a reason for leaving in 2019.2 Possibly these workers were unable to get care due to an already existing shortage of mental health professionals.3

As vaccines became available and infection rates began to subside, demand for goods and services increased sharply and businesses began to resume normal operations. However, workers did not return to fill newly available jobs in the numbers expected. As of November 2021, the labor force participation rate was 61.9%, as compared to 63.4% in February of 2020,4 and 11 million jobs were left unfilled.5

The reasons that workers are not returning to jobs, or even searching for new ones, are complicated and may include one or more of the following:

Labor shortages are affecting many industries, impeding the flow of goods and services across the board:

Leisure and hospitality, which shed the most jobs the fastest when the pandemic hit, continues to be disproportionately impacted. But workers failing to return and/or continuing to leave industries such as manufacturing and transportation that has caused a great slowdown in the production and shipment of many products. That combined with an unprecedented demand for computer chips has resulted in a shortage of goods from automobiles to medical devices. 7

For more information on labor attrition and shortages and the impact on industry, see Giving Notice: How Workforce Attrition Impacts Workers’ Comp in this issue of RxInformer. ➔

Since the start of the pandemic, 18% of healthcare workers have quit their jobs and another 31% are considering quitting. Sixty percent of those who are considering leaving their jobs report that they would leave healthcare altogether.8

Those healthcare workers who do remain are not only having to compensate for lost colleagues, they must also contend with various and unpredictable shortages of supplies from bandages to respirators – shortages that have healthcare system procurement professionals scrambling to find new supply chain sources. 9

Hospitals have been hard hit by some drug shortages, largely due to pharmaceutical factories in China shutting down and a delay in raw materials being shipped out of China and other locations. Availability for many drugs, such as azithromycin, metered dose inhalers (MDI’s), and opioids, decreased just as demand was surging to treat COVID-19 patients. Many other drugs unrelated to COVID-19 have also been in short supply, such as insulin.10 Other critical supplies, such as syringes, tubing, and catheters are also harder to procure,11 putting additional strain on overloaded healthcare workers and potentially compromising in-patient care.

The ripple effect of supply chain disruptions, along with ongoing price inflation, can make it challenging to keep up with the fluctuating scarcity and costs of healthcare goods and services, but some notable deficiencies that affect workers’ compensation healthcare include:

Oxygen: COVID-19 has caused a very high demand for oxygen, which many people who suffer from other chronic respitory ailments had already depended on. While oxygen itself is not in short supply, providing the specialized containers, vehicles, and drivers required to safely transport liquid oxygen has been a challenge. Nearly three quarters of suppliers have reported delays for this equipment and 67% reported increased costs, which causes hardship for patients who rely on supplemental oxygen and cannot get refills for home use as quickly and easily as they need.12

Basic Medical Supplies: U.S. companies that sell medical supplies such as gloves, cotton swabs, gauze, and other essentials, have long relied on overseas manufacturers to produce their products. When the pandemic hit, many governments required their manufacturers to supply their own countries before servicing overseas customers, which has caused a fluctuating chain of shortage and high prices. 13

Walking Aids: A long list of durable medical equipment (DME) in short supply includes an acute shortage of crutches, canes, walkers, wheelchairs, and braces.14 These products are manufactured with aluminum, one of a number of raw materials in great demand, leaving some hospitals and care facilities to request donations of unused equipment from their communities. Shortages of these supplies also hampers progress in physical therapy by delaying patients’ transition from wheelchair to walker to cane, etc.

Medical Monitors: Largely due to the backlog of computer chip orders, monitoring devices for blood pressure, insulin, and other vital information are taking longer to procure and costing more. A recent survey of medical technology companies found that 100% had experienced disruptions to their semiconductor chip supply chains and that 50% of the products they produce rely on such chips. 15

Diagnostic Equipment: Ultrasound machines, CT scanning devices, and imaging machines also require seminconductor chips. The competitition for chips is fierce because they are also used in a mutlitude of consumer items from automobiles to video game consoles. 16 When orders of new equipment are delayed for medical providers and there is a shortage of healthcare professionals available, patients have to wait longer for diagnostic tests, which can in turn, delay appropriate treatment.

Transportation: The automobile industry has also been severely affected by a shortage of chips, which are essential to the production of passenger cars. Fewer cars are coming off the assembly line and prices for both new and used cars have increased at rates not seen in decades. The price of gasoline is also higher than it has been in years and there is a shortage of drivers affecting rideshare and car service companies.17 All of these factors affect medical transportation prices and availability.

Home Health Professionals: The heavy responsibilities and light wages that are typical for home health aides have made good help hard to find for some time. Making it worse, many home health workers left their jobs due to illness or fear of contracting illness, burnout, or the need to care for children or other relatives at home. The shortage of home health aides has continued and is causing a gap between requests for home health services and the ability of agencies to meet those requests. The problem is not expected to get better anytime soon with home health aides projected as the occupation that will have the most demand for workers over the next decade.18

Workers’ comp payers have a vested interest in securing effective treatment for injured workers as quickly as possible. Insufficient access to diagnostics, DME, transportation, and/or home health services could potentially derail an injured worker’s recovery. When supplies are low, concerns about quality, cost, and potential fraud also increase. But, even amid serious supply chain disruptions, workers’ comp payers can still ensure access to quality care at the best available cost.

The unpredictability of current supply chain disruptions requires a multi-faceted mitigation strategy, including:

Many workers’ compensation payers rely on one or two ancillary medical benefits (ABM) vendors with whom they have established relationships and contracts. Unfortunately, this was a risky strategy even before the pandemic due to a great deal of merger and acquisition activity in the ancillary benefits market. With a high level of supply chain disruption, the likelihood that any single vendor may be unable to meet some demands as quickly and easily as usual is high. Ready access to alternative providers is the best way to ensure that injured workers will receive the treatments they need in a timely manner.

The time is ripe for purveyors of substandard goods and services to take advantage of supply gaps. It has never been more important to thoroughly vet vendors to ensure high quality at the best available price. Reputable, reliable vendors who have a proven track record of good service are always the best candidates, whether supplies are scarce or plentiful. However, initial vetting is not sufficient to ensure continued quality. Things can and do change, so it is important to measure quality within the context of the current environment — and that includes comparing vendors to one another to benchmark them.

Claims professionals who are tasked with sourcing supplies and services from individual providers, as opposed to using an integrated network of vendors, face a laborious and time consuming task, especially when items and services are harder to find. When products and services are scarce, being slow with an order or request increases the risk of failure. Some home health agencies are currently accepting well under 50% of the referrals they receive, 19 and fulfillment of other products and services could face similar odds. In addition, when prices are fluctuating, as they have been recently, claims professionals may lack efficient processes in place to check that the price they are getting is fair and is ultimately what gets billed. A digital system that connects payers and vendors to account for automated referrals, authorizations, and billing will greatly increase speed and accuracy to what was initially approved.

Monitoring, measuring, and comparing network provider performance is the only way to fully optimize managed care. Capturing and analyzing relevant data such as referral acceptance, turnaround times, formulary adherence, etc. is more important than ever to ensure that quality standards are met at the lowest cost possible. Comparing metrics between vendors not only informs current management strategy, but can assist in anticipating future industry trends. Data visualization can play a key role. For example, a bar chart of monthly price savings over time could reveal an undesirable trend that might have gotten lost in spreadsheets or disparate vendor data. Capturing and analyzing data is especially important when supplies, prices and staffing are fluctuating more than usual.

Significant supply chain issues existed long before COVID-19, but the pandemic exposed just how vulnerable our healthcare system is to disruptions involving labor, transportation, natural resources, and government policies. These factors are beyond the control of workers’ comp payers, but payers and their partners can work together to build resiliency within their own supplier networks, minimize risk, and ensure continued care for their injured workers.